"Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair."

- Sam Ewing"Money can't buy you happiness, but it does bring you a more pleasant form of misery."

- Spike Milligan

As I watched Richard Branson, the eccentric billionaire and founder of the Virgin Group, rocket to the edge of space last weekend, I felt profoundly mixed emotions. On the one hand, I marveled at the achievement that the first suborbital passenger flight to space represents, and human ingenuity, generally. Although I have absolutely zero interest in traveling to Mars (just getting to the office in Los Angeles traffic or fighting for a parking space at Costco are exciting enough) or starting an interplanetary real estate fund (not yet, but stay tuned!), the launch was thrilling to witness. Perhaps the flight was not quite as dramatic or significant as Apollo 11’s historic moon landing, but it certainly represents a significant milestone.

At the same time, however, Mr. Branson’s flight reminded me of the significant challenges we face back here on planet earth, and whether the billions being spent on these space-seeking endeavors by Branson and his billionaire brethren, Elon Musk and Jeff Bezos, could help address problems we face closer to home: increasing wealth inequality, a lack of affordable housing and homelessness, the private sector’s encroachment on and need to assume what were previously public sector responsibilities, the challenges businesses are facing to fill job openings, concerns about inflation, the lingering impact of the pandemic including a recent resurgence in cases and hospitalizations, and record heat waves and drought in some parts of the world and record flooding in others. And to think I did not even mention the toxic political environment, the tragic collapse of the Surfside condominium complex, or Brittany Spears’ conservatorship troubles.

I suppose it is a question of perspective as some of these realities present opportunities for Clear Capital and investors generally, who benefit from higher real estate values, rents, and stock prices, fueled in part by the impact these challenges create: a material undersupply of housing (both single- and multifamily), persistently low interest rates, and record levels of liquidity and household wealth. While we continue to face challenges with regards to rental collections, the lingering effects of the pandemic (past due rents across our self-managed assets exceed $4 million), and the uneven economic recovery, operating metrics (e.g., economic occupancies, rental rates) across our portfolio have improved substantially in recent months.

Thus, despite so many broad social, political, and economic challenges, the underlying fundamentals and outlook for Clear Capital and housing markets is very positive. As a result, we remain optimistic as we look out to the remainder of 2021 and beyond. Perhaps not surprisingly, we have been very busy of late, having acquired the following four assets (461 units) since my last update:

- Urban Park (Aspire Midtown), 104 units, Phoenix, Arizona

- Mountain View (Aspire West Valley), 96 units, West Valley City, Utah

- The Preserve (Aspire Oregon City), 135 units, Oregon City, Oregon

- Landing Point (Aspire Salt Lake City), 126 units, Salt Lake City, Utah

We anticipate presenting you with additional offerings shortly and hope one or more might interest you. I imagine we will also entertain offers to sell some assets, especially those where we have implemented our value-add strategy, captured higher rents, and can take advantage of favorable market conditions. With all this being said, highlights and relevant tidbits from the second quarter are as follows:

- Housing prices continue to skyrocket, while apartment rents have mostly recovered from pandemic-related declines (and then some), at least in most markets.

Perhaps the most common question I am asked is: “Are we in another real estate bubble?” The short answer is “no,” though it is easy to think so given recent headlines and countless tales about “all-cash, non-contingent offers above asking prices” for single-family homes in markets from Boise (ID) to Bethlehem (PA), to Tulsa (OK) to any Rust Belt City near you. Some buyers are acquiring homes, sight unseen, relying solely on video tours.

Anywhere one looks, data points confirm that we are in a strong bull market when it comes to housing prices. According to Zillow, the price of a single-family home in the U.S. increased approximately 15% during the past year (through June), with the median price nationally rising 24%, to over $370,000.

However, as much as significantly higher single-family home prices bring back memories of the period preceding the Great Recession, this time is indeed different, at least as I see it. Bank balance sheets are in far better shape, lending standards have not been materially relaxed, and average credit scores of borrowers are higher. Historically low interest rates, record levels of liquidity, anachronistic zoning regulations, institutional buyers (according to the WSJ, 20% of homebuyers are investors, including Blackstone, which reentered the single-family rental business after previously exiting it), a lack of buildable lots, higher commodity prices, and pent-up demand provide substantial market tailwinds.

And as sobering as it might be, many of these drivers of higher housing prices will persist indefinitely, such that lower single-family home prices are not likely anytime soon, as I have discussed in detail in prior newsletters and my podcast (“Focus on Facts”) several months ago. Meanwhile, a sampling of recent headlines captures the market sentiment surrounding home prices, and I could have cited dozens and dozens more, from nearly any news outlet or newspaper:

“The Housing Market is on Fire,” Bloomberg Business Week (June 14)

“Real Estate Frenzy Hits Small Towns,” Wall St. Journal (May 20)

“The East Bay Real Estate Market is So Hot, Housing are Selling for More than $1M over Asking Price,” SFGATE (May 5)

“Austin housing market sets new record as median home price hits $575,000,” Culture Map Austin (July 16)

“Long Island Home Prices Hit Record High Due to Insatiable Demand,” Newsday (July 15)

As if demand were not already strong enough, the Federal Housing Administration (FHA) recently announced that it is changing how it factors in student debt when assessing a prospective homebuyers’ creditworthiness and eligibility to qualify for FHA assistance. Clearly the change is intended to allow more borrowers to qualify for loans backed by the FHA, namely that superhero duo, Fannie Mae and Freddie Mac. The change will result in lower debt-to-income ratios for prospective borrowers with student loans, increasing the eligibility of certain prospective homebuyers for FHA-based loans. Perhaps increased competition from large debt funds and life insurance companies for some of FHA’s customers are compelling the change. Regardless, the competition and tremendous liquidity are compressing spreads, reducing borrowing rates, and increasing demand just as one would predict, although I am not sure the market needs any more demand drivers.

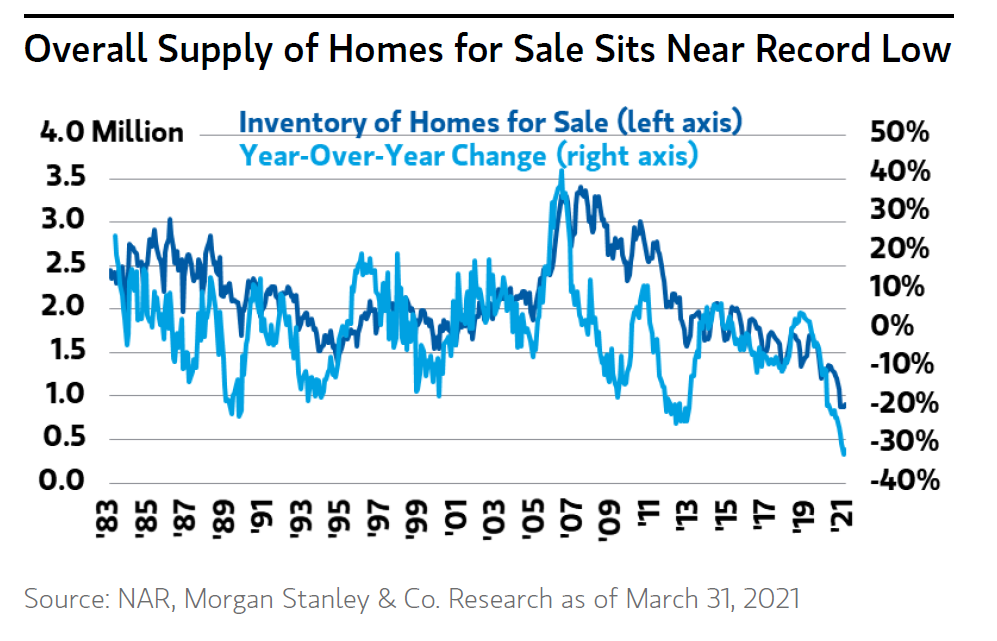

However, even if demand were to soften due to an economic downturn or increases in interest rates, neither of which I foresee, a systemic and persistent shortfall in supply remains the real culprit, as I have described previously, and I cannot foresee how that reality will reverse course anytime soon. The current supply of homes for sale represents less than 2.5 months of inventory versus 3.6 months one typically sees at historic cycle peaks. In many “hot” markets in the Southeast and Southwest, less than one month’s inventory is currently available. Earlier this month, Bank of America estimated that only 65,000 “starter homes” were completed in 2020, less than a fifth of what is typically built.

Sure enough, a new National Association of Realtors study reported that construction of new housing during the past 20 years fell 5.5 million units short of longer-term needs, requiring a “once-in-a-generation response.” Unfortunately, however emphatic their urging, it will go unheeded, but not because of a failure to acknowledge or recognize the problem. Political paralysis and the complete inability of competing factions to compromise and appreciate the most basic of principles, pitched back in the 18th century by the British philosopher, Jeremy Bentham, that the true measure of any “right” policy is that which provides the “greatest good to the greatest number” remain the culprits.

I even read that the U.S. is short of homebuilders themselves, which may, in part, also help explain the chronic undersupply of new housing. In 2007, the Census Bureau indicated that there were over 32,000 “spec” builders in the U.S. And today? Less than half that figure. There has certainly been some consolidation in the industry, while large, publicly traded homebuilders (e.g., D.R. Horton, Lennar, PulteGroup) have significant, if not insurmountable, scale and cost advantages over local or regional players.

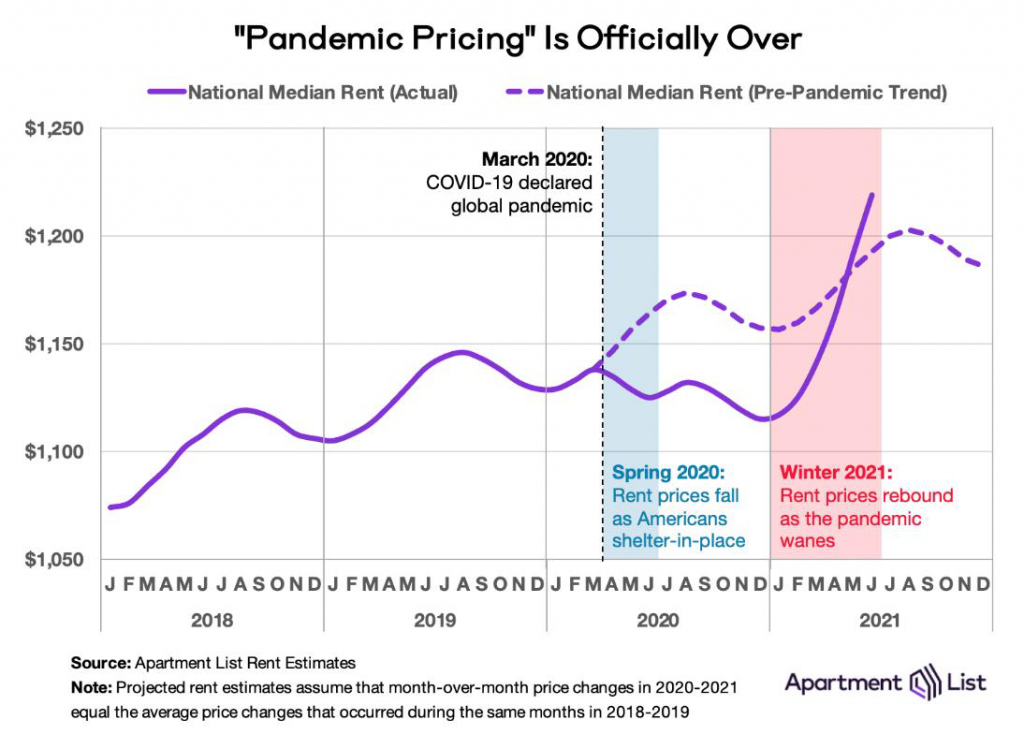

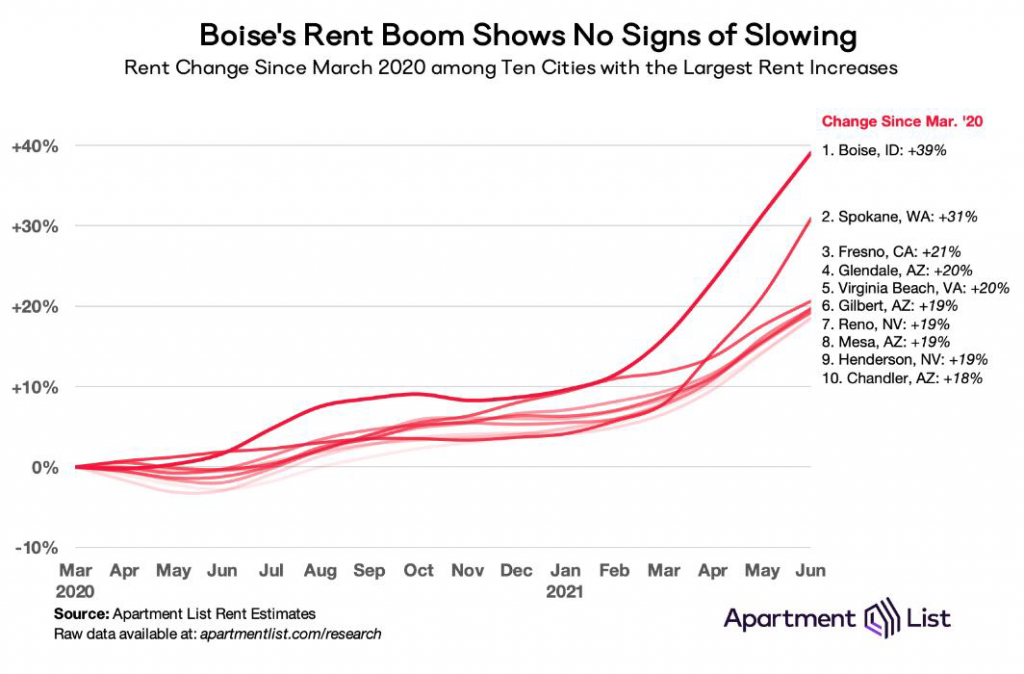

Meanwhile, rents have continued to recover from their pandemic swoon. Nationally, apartment rents increased 2.3% in June and are up 9.2% for the year. In 38 of the largest 50 metros, rents hit new peaks during the quarter. One pattern arising during the pandemic perpetuated, as suburbs led in rental growth. Among the markets that witnessed rent increases of more than 15% during the quarter include Riverside (CA), Memphis (TN), Tampa (FL), Phoenix (AZ) and Sacramento (CA). Even rents for single-family homes were up sharply during the quarter, up over 5% year-over year.

Moreover, the number of occupied apartments in the largest 150 metros increased by nearly 220,000 units in the quarter, the largest quarterly increase since the early 1990’s when such data was first tracked. Here, markets in the Sunbelt and previously hard-hit urban coastal markets led the way. However, national figures mask significant regional variations, as many markets, mainly coastal, continue to see rents well below pre-pandemic levels. For example, rents in San Francisco and New York City remain nearly 15% lower than those witnessed in March 2020, though they have rebounded sharply, up 17%, since the start of the year.

Perhaps the biggest challenge remains collections, or differences between physical and economic occupancies. However, while tenants continue to struggle to pay rent on time, before the end of the first week of any given month, they are mostly paying and meeting obligations.

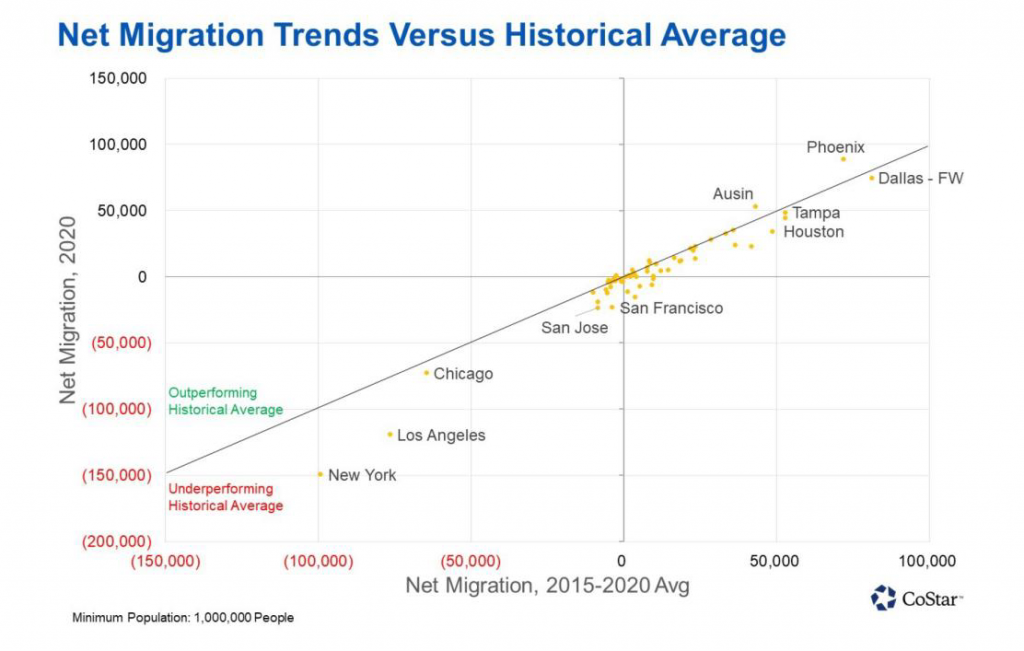

- Secondary, tertiary, and quaternary single- and multifamily markets continue to outpace coastal competition.

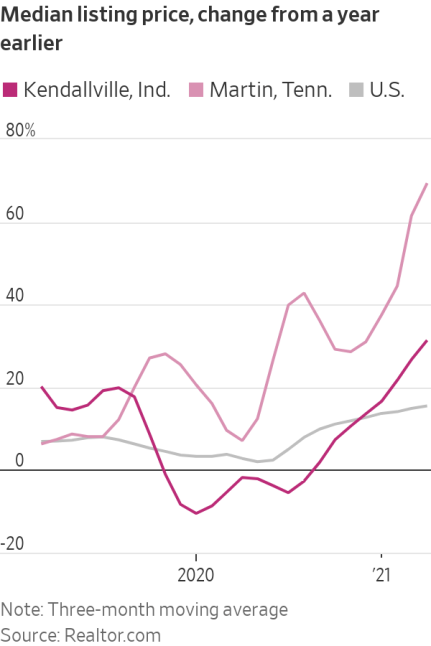

You may recall that I mentioned that the “hottest” single-family real estate market during the first quarter of 2021 was Fresno, California, according to the Wall Street Journal. However, I may need to offer a mea culpa because I subsequently read articles elsewhere that claimed the hottest market might have been either C’ouer D’Alene (ID); Glendale, (AZ); or, Kendallville, (IN), depending on the news source.

Perhaps we are merely splitting hairs and getting lost in the trees, while missing the forest, that the market leaders – whether Fresno, C’ouer D’Alene, or Glendale – are an unlikely bunch of tertiary markets, not nearly primary or coastal. Even Harry Potter and his wizardry would find affordable housing in Hogwarts hard to find. I am not sure Clear Capital will be pursuing opportunities in any of these markets, especially Hogwarts, though the graph below indicates that perhaps we should, if the multifamily fundamentals and price changes in these same markets are like those impacting single-family home prices.

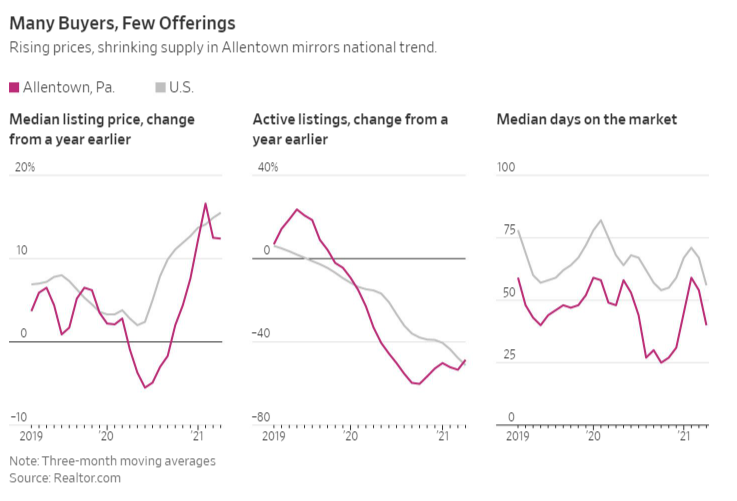

Perhaps a different view, data from Allentown (PA), where they may have “closed all the factories down,” according to Billy Joel, indicates that even that particular market has not experienced tempered housing demand, at least recently.

The story is precisely the same in the multifamily market, as alluded to above and discussed in previous quarterly memos, and precisely why Clear Capital continues to pursue opportunities in markets like Colorado Springs, Salt Lake City, and Phoenix. Pictures do indeed tell a thousand words.

- While concerns about inflation remain widespread and the topic of countless news articles, the bond market is telling us such worries are overblown.

It is truly remarkable how the focus of reporters can change on a dime (or perhaps a quarter these days?). For years, I saw few articles that raised the specter of higher inflation, even as the Federal Reserve was printing money at record rates and asset prices continued to grow. And now? Nary a day goes by without one economist or another raising the prospect of systemically higher inflation.

It is really no wonder, as just last week the Labor Department reported that the Consumer Price Index rose 0.9% in June, the largest monthly increase since June 2008, and increased 5.4% over the last twelve months. Core inflation, which strips out volatile food and energy prices, rose 4.5%, the largest increase in that measure since September 1991. Everywhere one looks, whether it is your local Chevron, Home Depot, or Chipotle, higher prices are on the menu (the menus at Chevron and Home Depot might be worth avoiding).

And if companies are not increasing prices, they are accomplishing the same objective by shrinking the sizes of their products, something NPR creatively called “shrinkflation.” For example, Bounty may be the “quicker-picker-upper,” but it recently has been a “quicker-paper-shrinker,” reducing its package sizes by nearly ten percent.

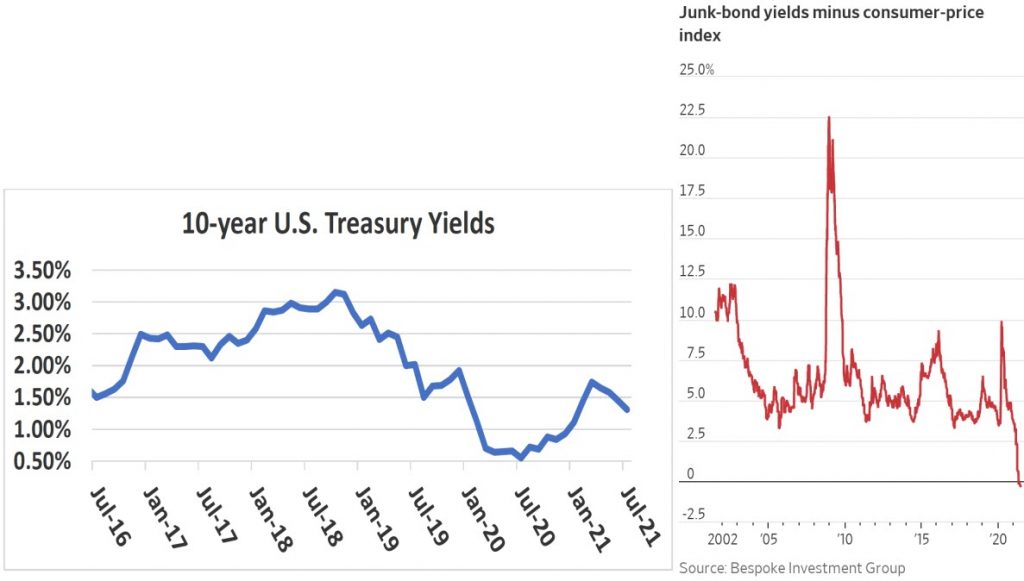

And the market’s reaction to these higher inflation figures? Pretty much the same as the reaction I often get from students during one of my Zoom-based classes (and perhaps even the in-person ones), yawwwwn, if recent yields on ten-year Treasury yields – 1.17% at last glance - and other bonds are any indication. Keep in mind that ten-year Treasury yields were 1.75% at the end of the first quarter. Meanwhile, rates on high yield (read: junk bonds), averaging approximately 3.9% today, have fallen below inflation for the first time.

Plummeting bond yields are as strong as indicator as any that the market seems profoundly

unfazed by recent inflation data.

However, while headline inflation figures may have significant shock value, they become less

concerning when one realizes that more than a third of the inflation figures came from

increases in the prices of used cars. Yes, used cars. So long as Costco continues to charge

only $1.50 for a hot dog and drink, I maintain that inflation is not a longer-term systemic

problem. Rest assured, I will also be watching whether Costco’s hot dogs experience

“shrinkinflation” and will report back as needed.

Seriously, whether higher inflation is here to stay may be the most significant debate

between economists and market pundits these days. It is really an MMA battle between

competing forces. Supply chain disruptions caused by COVID will ease, as will pent-up

demand, both of which have created inflationary pressures. Meanwhile increased

investment in automation and unfavorable demographic changes (i.e., lower fertility rates,

later marriages) provide inflationary headwinds.

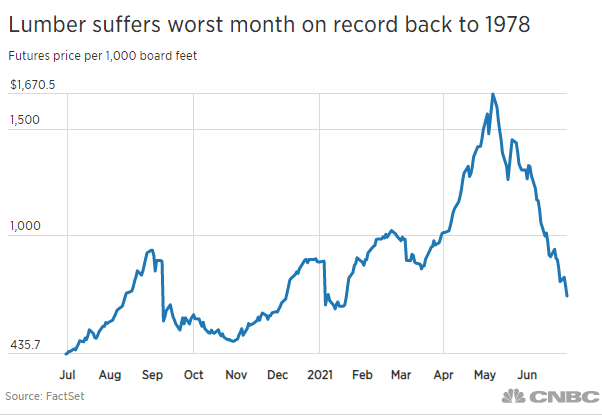

Perhaps one promising sign is the sharp reversal seen in lumber prices, which had risen to

record levels in May ($1,670.50 per 1,000 board feet on May 7th), only to drop more than

40% in June. You may recall that significant increases in virtually every commodity, from

oil to copper to aluminum to steel, had raised the cost of constructing a single-family home

by some 25% in a mere twelve months.

Obviously, Jerome Powell and the Fed are monitoring the data closely and they recently indicated that the discount rate may be raised earlier than expected, by late 2023. We will need to see how the Fed responds should higher inflation figures persist, and as usual, my popcorn is at the ready.

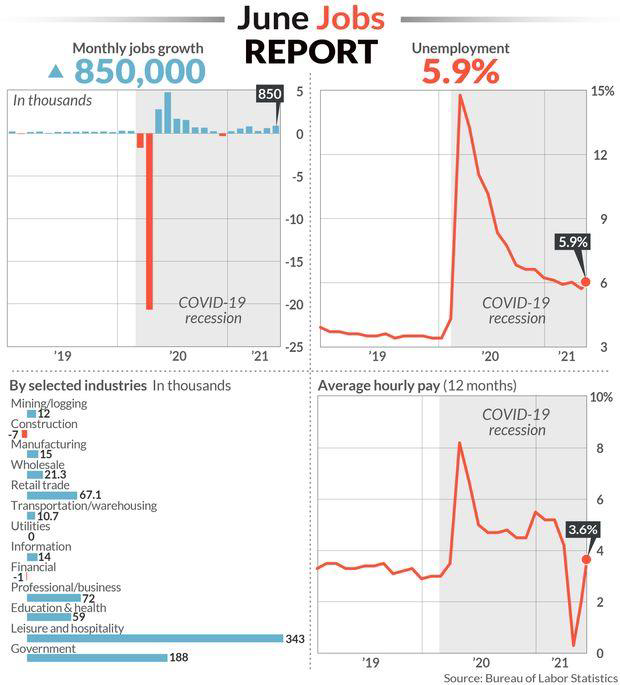

- While the employment picture continues to brighten, countless businesses are unable to fill open positions, adding to the uneven economic recovery.

Following questions about future inflation, the second greatest economic uncertainty involves jobs and wages. While employers added 850,000 jobs in June, the unemployment rate rose to 5.9%, from 5.8%, as more folks began to look for work (remember that people not looking for work are excluded from unemployment figures). Overall wages increased 3.6% in June.

One significant uncertainty is whether recent wage increases portend a longer-term trend, and my sense is that they do. McDonalds recently announced that all 36,500 of its personnel (in-facility) will receive raises averaging ten percent, that entry-level hires will see wages increase from $11 to $17 an hour, and average wages for all staff paid hourly will reach $15 by 2024. Olive Garden and Chipotle have also recently announced wage increases.

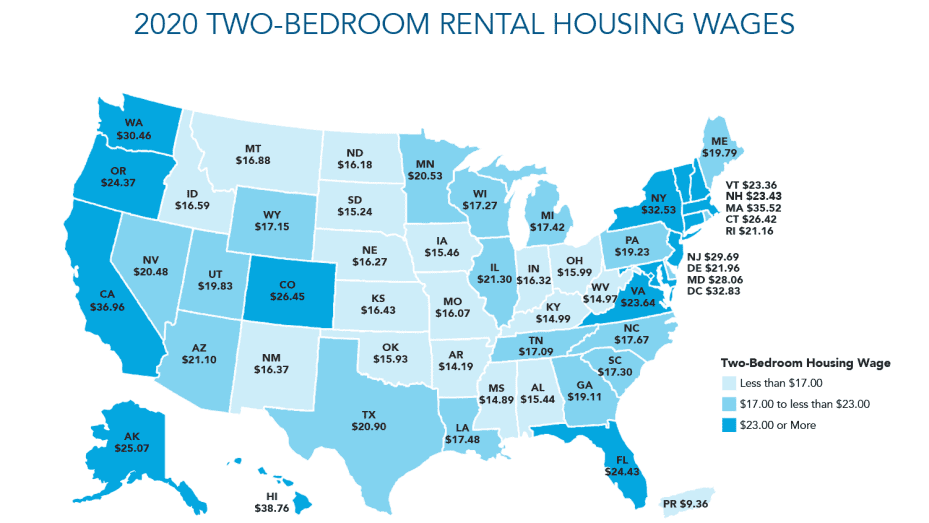

However, countless businesses remain unable to fill open positions, with some 2.4 million job openings available in both the leisure/hospitality and manufacturing sectors. Those of us who have returned to in-restaurant dining have likely experienced understaffed locations. I recently visited a local mountain resort, Big Bear, and several restaurants were clearly short waitstaff and bussers, with the lack of affordable housing in the area receiving most of the blame when I raised the subject. A recent WSJ article, “Factory Jobs Go Begging as Wages Fail to Keep Up” indicated that increases in pay for factory jobs has been so anemic that they cannot even compete with fast food operators. That will need to change.

Many blame unemployment benefits (including the $300 federal benefit supplement) as the culprit, pointing out that they act as a disincentive for workers to return to their jobs. For some, this is likely the case. However, the true causes for labor shortages are far more numerous and complicated, and include everything from those enhanced unemployment benefits, a lack of affordable housing, increases in remote work, fear of (re)infection, a shortage of available childcare, and the pandemic-compelled exodus from urban cores to the burbs. Some workers may have used the pandemic to pursue other alternatives, everything from real estate brokerage to trading meme stocks and cryptocurrencies.

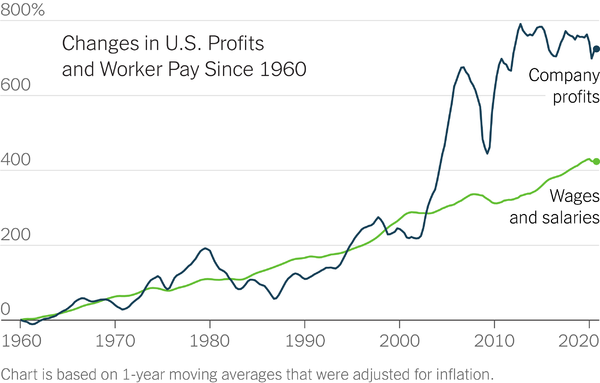

However, the reality is that real wages have stagnated in recent decades and have simply not kept up with increases in corporate profits or housing costs, even as labor markets tightened. As a share of GDP, worker compensation is lower than at any point in the second half of the 20th century, resulting from corporate consolidation, shrinking labor unions, automation, and Amazon. One data point that caught my eye and highlights the issue is that the average S&P 500 company CEO made 299 times the average worker's salary in 2020, according to AFL-CIO's annual, “Executive Paywatch report.” Executives received $15.5 million in total compensation on average, representing an increase of more than $260,000 per year over the past decade. At the same time, the average production and non-supervisory worker in 2020 earned $43,512, up just $957 a year over the same time period.

However, I believe these trends are going to change, and must change, to paraphrase Bob Dylan. First, just like the pandemic disrupted supply chains generally, labor supply was similarly impacted. However, challenges in labor supply may not be quite as easy to fix without significant additional incentives provided to workers. Second, thanks to the extraordinary rise in asset prices, including homes, some older workers are likely to retire sooner, perhaps also taking advantage of low rates to secure one of those reverse mortgages peddled by Tom Selleck. Third, lockdowns may have impaired some workers’ ability to return to their jobs due to health issues or a lack of childcare. And finally, while unemployment benefits will eventually burn off, they will create additional employment headwinds. Collectively, these factors suggest less labor force slack than is usual at this stage of a recovery, and higher wages are in our future.

Finally, wages need to increase to allow workers to afford housing in the communities in which they work. Several years ago, I was having dinner with two friends up in Seattle, and I asked them where they thought the busboy lived. They had no idea. I responded that we need to understand the answer to that question if we are not going to experience labor disruptions in service businesses located in tight housing markets. The math is simple, as reflected in the map below, that wages far above the minimum wage are required for workers to afford the rent in most communities.

- The pandemic materially accelerated the domestic diaspora, a population exodus from the coasts to less expensive locales.

Over the past several years, I have written extensively about the population exodus from the coasts further inland, a sort of Manifest Destiny in reverse, as people sought more affordable housing, lower taxes, and perhaps places with less red tape and bureaucracy. However, one significant driver of this domestic diaspora that I have not discussed is how the Southwest has emerged as the country’s new factory hub.

Five states – Arizona, New Mexico, Texas, Oklahoma, and Nevada – added more than 100,000 manufacturing jobs from the start of 2017 to beginning of 2020, representing 30% of US. employment growth in the sector. As Silicon Valley’s influence becomes more widespread and fragmented, markets like Phoenix, Denver, Austin, Henderson/Las Vegas, and other cities should see increased tech-based jobs, and along with those high-paying jobs, greater demand for housing.

For example, Taiwan Semiconductor Manufacturing Corporation, the world’s largest contract chip manufacturer, whose products are in significant demand, selected Arizona as the site for a new $12 billion factory, which will employ some 1,600 workers. Intel is already active in that market and is expanding there. From Tesla to Lucid Motors to Steel Dynamics, numerous firms are expanding from traditional manufacturing hubs and coastal markets to places like Nevada, Arizona, and Texas. COVID and the supply chain disruptions it brought have only accentuated the trend.

- Governments at all levels – local, state, and federal – continue to wrestle with how to minimize evictions of tenants delinquent on rents and homeowners behind on mortgage payments.

One significant uncertainty and concern of politicians (and others) is what will happen to tenants behind on their rent or homeowners delinquent on their mortgages when various moratoriums and/or forbearance agreements burn off later this year. During the last week of June, the Biden Administration announced a one-month extension of the CDC eviction moratorium, which was set to expire, and that the government will expedite the distribution of the $46 billion in emergency rental assistance established by Congress as part of the last stimulus bill. They also indicated there would be no further extensions, though whether they follow through on such an assurance remains to be seen. George Bush taught me long ago not to trust everything politicians say, even when you read their lips.

Meanwhile, California extended its eviction moratorium through September and has proposed paying landlords all missed rent for low-income individuals and families, a proposal that would cost a mere $5.2 billion. We hope California follows through on this proposal given how much we have at stake given the delinquencies we have experienced across our California-based assets. New York has extended its moratorium until the end of August. Most other states have let their eviction moratoriums lapse but are offering other rental assistance programs.

We continue to work with tenants when possible and have received payments for delinquent rents from various programs, but it is a slog as governments have not been exactly speedy (shocking, I know) in processing claims.

- As usual, before I wrap up this edition of our quarterly update, there are a few other noteworthy data points to consider.

- Biden Tax Proposals and 1031s: I am often asked whether 1031 transactions are going to go bye-bye if Congress decides to close an invaluable loophole that has been available to commercial real estate investors for nearly fifty years. If Biden has his way, 1031s would be eliminated or be significantly curtailed, closed to investors with pre-tax real estate profits over $500K. But political realities being what they are, I do not believe any meaningful tax reform is forthcoming. Heck, bipartisanship cannot even be found to pass an infrastructure bill.

- Office Space Outlook: Last week, as I was driving past downtown Los Angeles, I noticed three large cranes putting what appear to be the finishing touches on three separate high-rise office buildings. I imagine all three are going to suffer significant losses, as they struggle to find tenants in a post-COVID world. Office vacancy rates have increased sharply since last spring, and I cannot foresee any forthcoming respite. It will be interested to see if some office projects are converted to alternative uses, but I imagine that will be no easy task, and certainly not an inexpensive one. Obviously, the outlook has improved in recent months, but I still foresee a very challenging office market looking forward.

- IPOS, Corporate Debt, and Rising Zombies: Since the end of Great Recession, corporations have added trillions of dollars in debt, much of which is investment grade or lower. Globally, corporations owe over $80 trillion, nearly a quarter more than they did in 2008, with one long-lasting legacy from the pandemic being the sharp increase in corporate debt. Non-financial firms issued a record $1.7 trillion in bonds in the U.S. last year, some 30% higher than the previous record. By end of the first quarter of 2021, total debt for such firms reached $11.2 trillion, with some of the biggest borrowers being those hit hardest by the pandemic: Carnival Cruise Lines, Boeing, and Delta. Low rates are hard to resist, and while corporate bankruptcies have been few and far between as a result of government largesse and the willingness of investors to fund “zombie” companies, I don’t see this trend being sustainable.

- Governmental efforts to increase fertility rates: One concerning trend I have mentioned many times in recent years has been the decline in fertility rates because of its longer-term impact on the economy and housing. At end of April, the Census Bureau reported that decade ended 2020, U.S. population grew at slowest rate since the Great Depression and second-slowest rate in any decade since our country was founded. However, declining fertility rates are a global phenomenon and governments are doing their part to stimulate reproduction rates (insert joke here). I recently read that China is now “allowing” families to have three children and two weeks later, I saw another article that said that China is poised to “lift all childbirth controls.” China clearly recognizes that policies limiting family sizes might have significant demographic and economic impacts looking forward. However, without associated economic incentives, I cannot see how such a policy will have any meaningful impact. After all, having children costs a lot, and is not getting any less so. Closer to home, the American Rescue Plan passed earlier this year increased the child tax credit to $3,600 for each child under 6 and to $3,000 for each child up to age seventeen. The Biden Administration has also proposed the expansion of paid-leave programs and improved childcare access. Regardless, I do not see any of these policies having any meaningful impact.

Overall, as the length of this update indicates, the second quarter had plenty of data to consider and evaluate, and while the outlook for housing – both single- and multifamily – is very positive, significant uncertainty surrounding everything from inflation, employment, and COVID variants remain.

Between the U.S. Department of Defense confirming that certain sightings by naval pilots were, in fact, UFOs, Richard Branson rocketing off to the edge of space, and an unidentified individual bidding $28 million to accompany fellow billionaire astronaut wannabe Jeff Bezos’ on a similar journey, the second quarter truly included news that was other-worldly. Oh, and by the way, the winning bidder for the Bezos space flight ultimately decided not to go, forfeiting the $28 million they paid for the ticket. If anyone happens to know their identity, would you be kind enough to pass along the name to our Investor Relations personnel?

Here, back on earth, there are many areas of concern, but perhaps ironically, nearly all provide foundational support and tailwinds for housing prices and rents. That is not to say that there are not areas of concern: elevated asset prices, continued speculation in meme stocks, cryptocurrencies, and SPACS (Special Purpose Acquisition Companies), high levels of corporate debt, the bloated Federal Reserve balance sheet, and the specter of higher inflation are all areas of concern, and I will be paying close attention to all of these issues, like many investors.

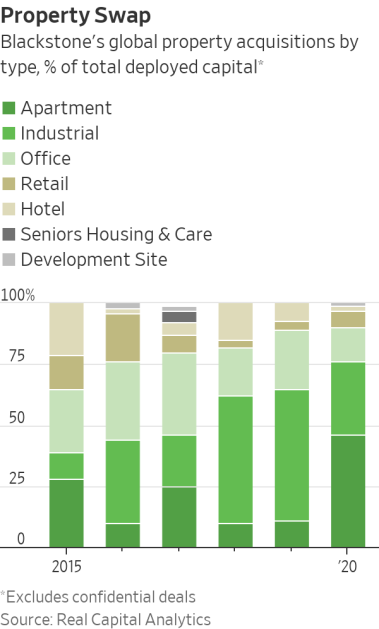

Meanwhile, the confluence of record-high values in single-family homes, equities, and virtually all commodities, coupled with record-low interest rates and tremendous liquidity has compelled investors to assume greater risk in the search for higher yields and returns. A recent WSJ article focused on how certain real estate investors, including Blackstone, are placing greater and greater sums into niches like data and research centers and life science labs.

While such a shift by Blackstone and others may prove prescient, I am always mindful of when investors – whether retail or institutional – shift strategies and move further along the risk curve. My experience is this tends to occur towards the end of cycles. Rest assured that Clear Capital will resist the temptation to move away from our core strategy that has proved well over decades and shifting market cycles.

Finally, I wanted to express my sincere appreciation and thanks to you, our investors and supporters, as well as the entire Clear Capital and Clarion Management (our captive management company) teams for their extraordinary efforts over a challenging period. I am beyond grateful and feel very fortunate to work alongside such a talented and dedicated group of individuals.

Best,

Eric Sussman