Clear Capital Acquires a 3-Property, 234-Unit Multifamily Portfolio in Inland Empire, CA

Clear Capital, LLC

FOUNDED: 2010

HEADQUARTERS: Irvine, Los Angeles

FOUNDERS: Eric Sussman, Greg Worchell, Daniel Hardy, Paul Pellizzon

BUSINESS: Multifamily Real Estate

RECENT ACQUISITION: 234-Unit Value-Add Apartments Communities in Inland Empire, CA

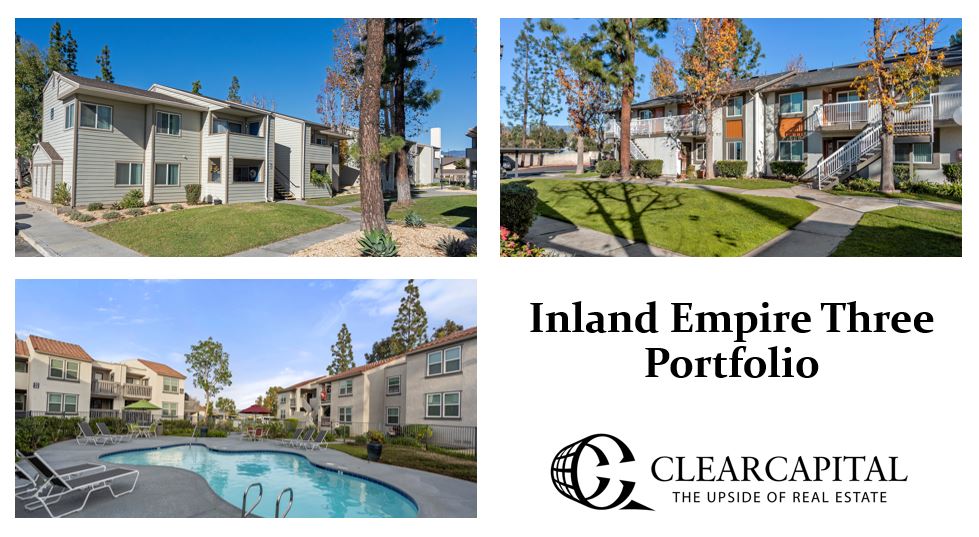

IRVINE, CA, June 15, 2023 – Clear Capital, LLC a West Coast-based private equity investment firm specializing in multifamily real estate, announces the acquisition of the Inland Empire Three Portfolio (IE3) in Inland Empire, CA. The 234-Unit, three-property portfolio will be re-branded as Aspire Corona, Aspire Redlands and Aspire Rialto upon takeover. This purchase marks Clear Capital’s 40th investment in the United States and a total of 14 properties in California.

Each asset in the IE3 was built between 1985 and 1987 and features one- and two-bedroom units with spacious condominium-style floor plans and amenities. With approximately 63% of total units in classic or partially renovated condition, the assets are positioned for value-add interior renovations. The acquisition of IE3 highlights the company’s consistent investment strategy of purchasing value-add opportunities in desirable locations, with significant rental and operational upside. This investment aims to provide a current cash yield with a double-digit levered IRR over a 5-7 year hold period.

Clear Capital plans to leverage our extensive experience and knowledge of the Inland Empire market alongside our vertically integrated property management company to reposition the assets as market leaders in their respective sub-markets.

“Clear Capital is thrilled to be investing in our backyard. Our roots began in Southern California, and we are excited to provide investors with the opportunity to invest in an area where we have been incredibly successful,” stated Eric Sussman, a founding partner of Clear Capital.

Throughout the last decade, the Inland Empire has become a prime location for logistics and manufacturing, making it one of the largest and fastest-growing hubs in the United States. Its proximity to Southern

California ports and affordable land, make it an ideal location for businesses in need of efficient transportation. With almost one-third of all U.S. imports coming through Los Angeles ports, the metro rail and highway connections have become invaluable for shipping to destinations farther inland.

The Inland Empire’s economy is heavily reliant on the logistics sector, which has expanded at a historical rate in California. Job growth has averaged 49,000 per year since 2012, bolstering the region’s employment base by a remarkable 40.3% – outpacing every major metro in the state in job formation and retention.

The metropolitan area is comprised of two counties, Riverside and San Bernardino, and 52 incorporated cities, with Riverside County experiencing one of the fastest-growing populations in the state. The area’s many retirement communities create outsized demand for healthcare and education services, further expanding employment opportunities to service these rapidly growing communities. As the retail, leisure and hospitality sectors slowly recover and continue along previous growth trajectories, additional employment opportunities for residents of the Inland Empire are expected to arise. Overall, the Inland Empire presents a lucrative opportunity for businesses looking to invest in a thriving logistics hub with a growing population and diverse economic opportunities.

About Clear Capital

Clear Capital is a West Coast-based private equity investment firm specializing in multi-housing real estate investments. The firm focuses on acquiring, renovating, repositioning, and managing multifamily housing assets throughout the Western, Mountain, and Sunbelt regions of the United States. Clear Capital owns and operates a diverse portfolio of multifamily communities with over 4,300 units with over $1 billion in value in 6 states. Clear Capital’s distinctive approach to investing in real assets has consistently produced above-average risk-adjusted returns for its investors. For more information or to invest, please visit clearcapllc.com. Follow us on LinkedIn and Facebook for the latest company developments.

Contact:

Tania Kapoor Mirchandani

Vice President Capital Markets

(323) 642 – 9632