Greg Worchell, Enrique Huerta, Scarlett Jia, Stav Graziani

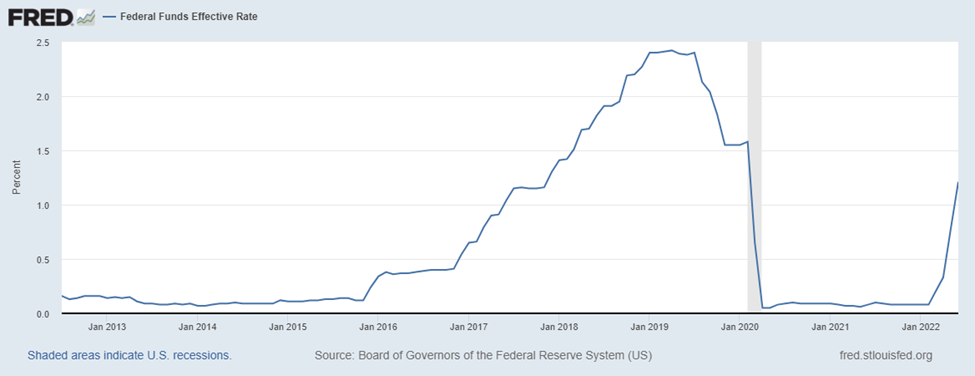

Q2 2022 saw the sharpest increase in US interest rates since the Great Financial Crisis. As a result, uncertainty looms across all asset classes – equities, bonds, alternatives, and real estate. Clear Capital witnessed an almost immediate dislocation in the multifamily real estate market in light of recent economic developments.

With the federal funds rate increasing and further rate increases projected, lenders immediately tightened underwriting standards, required additional equity, and ended entire lending programs seemingly overnight. The rate hikes led to a significant disconnect between buyers' and sellers' opinions on property values. More than half of the existing transactions we monitored fell out of escrow. If a trade did make it to closing, it wasn't without a reduction in the purchase price, or a material change in other transaction terms that affect property valuations. As the dust settled, the immediate impact was a 5%-10% reduction in property values. Still, Clear Capital expects a further 5%-10% decline as interest rates continue to rise, rent rolls "season," and income starts to stabilize at the property level.

A lot of anecdotes we've heard point to lenders reducing loan proceeds, buyers expecting discounts, and sellers still holding onto valuations from Q1 2022 and EOY 2021, which has led to a short-term "freeze" in the investment sales environment. Inventory has plummeted, prices haven't adjusted fully, and Clear Capital's Acquisitions team has been hard at work turning over every rock to find compelling investment opportunities. Along with an additional 5%-10% reduction in values and lenders cautiously re-entering the lending space for good quality, workforce housing assets, like those that CC invests in, we will be in a position to acquire an additional 3-5 investment opportunities before YE 2022.

In prior communications and company webinars, you may have heard our Acquisitions team targeting up to 20 transactions (including dispositions) for 2022. A lot has changed. With the new interest rate environment, lower inventory, and more extensive equity requirements, we have recalibrated our expectations to 12-15 transactions. We are grateful to have completed 7 acquisitions before the turmoil in the capital markets and are on track to dispose of 3 portfolio assets. We reasonably believe we can acquire 3-5 additional assets for the portfolio – opportunities in which you, our valued clients, will have a chance to partake.

As always, we like to set the correct expectations: EOY 2021 saw record-breaking valuations on a price per unit basis and the lowest cap rates EVER. In the future, we expect to acquire assets at a lower (read: better) price per unit and a higher (read: also better) cap rate going in, but return expectations will remain in line with historical offerings given our higher equity investments (40%-45% now versus 30%-35% before). Many investors may believe they should receive an outsized return for the risk of investing today. Still, despite these "similar" returns, Clear Capital remains committed to identifying and acquiring high-quality investment opportunities with conservative underwriting, prudent leverage, and substantial, long-term intrinsic value. As a result, consider the return profile of all options on a risk-adjusted basis and not only on a surface-level IRR number. As always, we aim to under promise and over deliver and expect to continue our success in this new market environment.

In addition to monitoring the market and seeking compelling opportunities, our Acquisitions and Asset Management team is responsible for overseeing each asset's business plan and ensuring the success of each property. One immediate effort we undertook to de-risk our portfolio was to assess the cash flow needs of each property, identify opportunities for reducing leverage, and proactively bolster reserves should we enter a recessionary environment. Our team then took this analysis and revamped our underwriting processes to:

- Move away from higher leverage bridge financing into lower-leverage and more stable government agency loans.

- Adjust rent growth downward.

- Increase the budgets on our Capital Expenditures and other replacement reserves.

- Expand exit cap rates to better align with a historical investment environment.

- Expect delays in construction timelines on value-add projects.

With all these changes, we are merely being cautious and continuing to remain disciplined in our underwriting approach. We recognize the dire inflation numbers and economic uncertainty. Still, we believe that multi-housing investments will achieve compelling returns through this financial period and over the long run. The headwinds are strong; inflation, affordability, and higher interest rates. The tailwinds, however, outnumber the headwinds: pent-up demand, strong rent growth, housing assets as an inflation hedge, much-needed wage growth, and lower home buying demand from would-be homeowners that must now rent due to higher interest rates and larger mortgage payments.

With that said, we continue to monitor the markets for compelling opportunities, manage our portfolio to reduce risk and improve operations, and look to continue exceeding your expectations. Rest assured, the Clear Capital team remains committed to capital preservation first and foremost, and solid, steady growth as the icing on the proverbial investment cake.

As always, the entire Clear Capital team thanks you for your continued trust and confidence in our team, and we wish you well on your investing journey and beyond.