“These Prices are Insane”

- Eddie Antar (“CEO, Crazy Eddie”)

“I continue to believe that the American people have a love-hate relationship with inflation. They hate inflation, but love everything that causes it.”

- William E. Simon

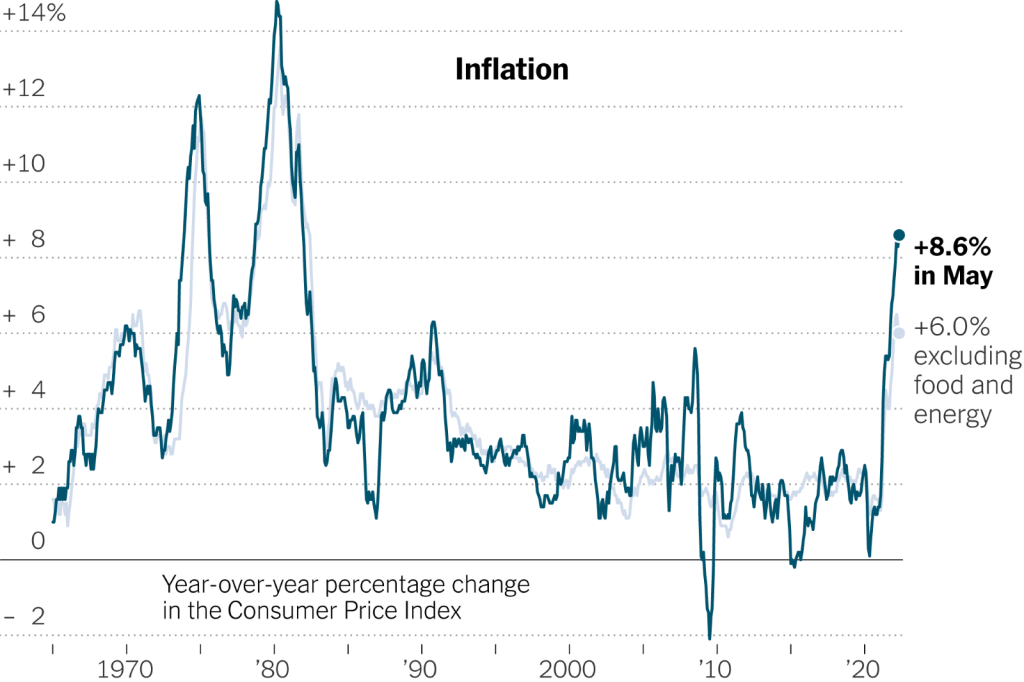

Following May’s sobering inflation data and an 8.6% increase in consumer prices year-over-year, Fed Chair Jerome Powell took a page out of Paul Volcker’s 1981 Federal Reserve playbook, “How to Quell Inflation Regardless of the Consequences” and raised interest rates by 0.75% late last week, the largest such increase since 1994.

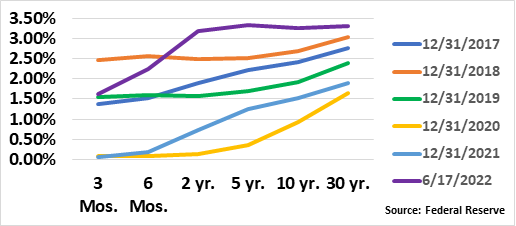

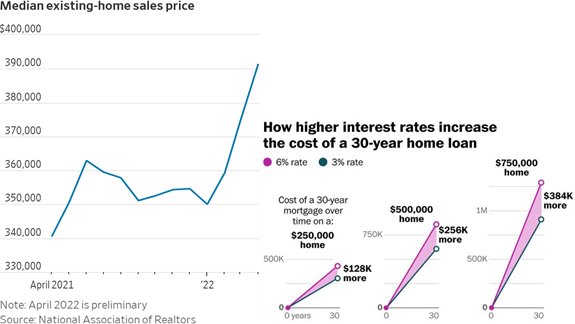

Meanwhile, U.S. Treasury yields and mortgage rates have soared, with the latter reaching their highest levels in over 10 years. It is hard to imagine that 30-year, fixed mortgage rates averaged less than 3.0% in 2021 (2.96%, to be precise) and now average almost 6.0%, roughly doubling in a mere six months.

Keep in mind that Volcker faced far more daunting, double-digit inflation when he was appointed Fed Chair in 1979. Inflation was rising at over one percent each month and home mortgages averaged 11.2% at the time. The Fed Funds rate was just under 11%, and by the June of 1981, after a series of aggressive moves to quell inflation, the Fed Funds rate exceeded…19%. Imagine that. 19%.

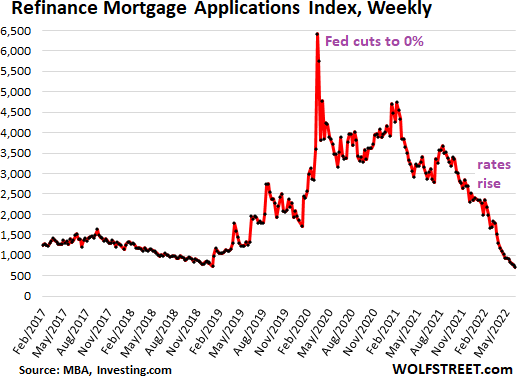

In response to the most recent Fed actions and the higher rates in 2022, mortgage applications for both new home purchases and refinancings have plunged and the housing market slowed, with nationwide inventory of homes for sale up about 10% in recent weeks. Overall, in over 80% of the nation’s 400 largest housing markets, inventory levels have risen during the past six weeks, although they remain below pre-pandemic levels.

So, let’s cut to the chase. How do we expect investments in real estate and multifamily assets to perform in this backdrop of higher inflation?

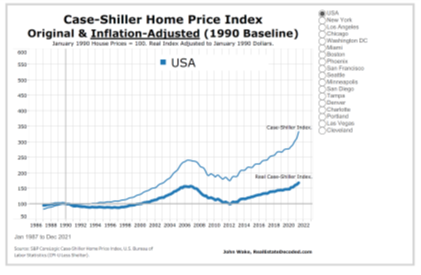

If history provides guidance, investments in real estate ought to perform relatively well in an inflationary environment. The first graph was included in a memo we published last year and demonstrates that single-family homes have provided positive real returns (above inflation) since 1990.

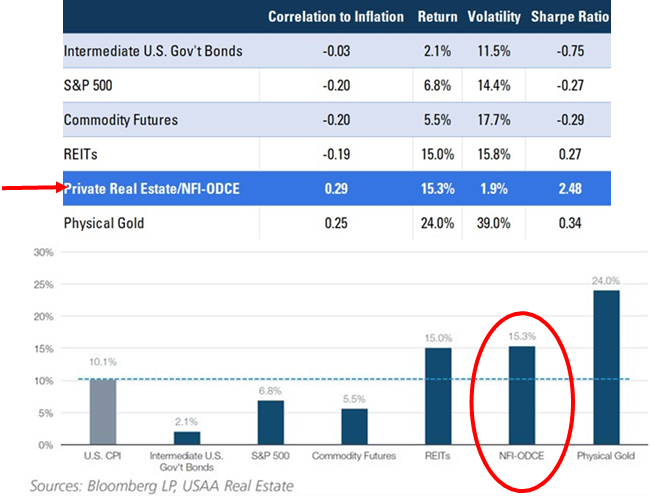

Meanwhile, during 1978 to 1981, a period some refer to as the “Great Inflation,” private real estate exhibited the highest correlation to headline inflation of all major asset classes. Private real estate also had the most favorable risk-adjusted return profile during this period, as illustrated below.

Private Real Estate vs. Major Asset Class Classes

During the “Great Inflation”

(March 1978 - September 1981)1

A paper published in November 2011, “Inflation and Real Estate Investments,” written by Brad Case, Senior Vice President of NAREIT, and Susan Wachter, Professor at Wharton, evaluated how publicly traded Real Estate Investment Trusts (REITs), the most transparent of real estate investments, perform in inflationary environments and came to a similar conclusion. In 1979, when the consumer price index averaged 13.5%, total REIT returns were 24.4%. During 1978 to 1980, when inflation averaged 11.6%, REITS’ total returns were 23.1%, and from 1974 to 1981, when the CPI averaged 9.3% per year, REITs returned 16.3% on average. Even though REITs have performed well historically they are down YTD due to the market correction while private real estate markets are in positive territory.

And multifamily investments? In theory, multifamily investments ought to perform well in an inflationary, high interest-rate environment for the following reasons:

- Short-term lease structure: Because leases of multifamily assets are relatively short-term with durations of one-year and less, rents can adjust reasonably quickly to inflationary pressures.

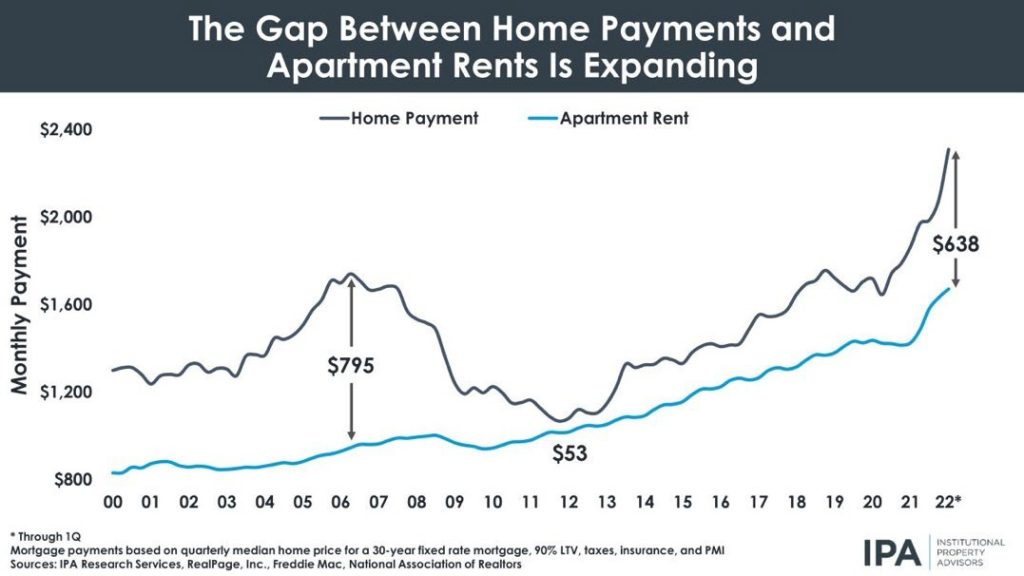

- Higher required down payments and ongoing mortgage costs: As single-family homes become less affordable and mortgage rates rise, higher down payments and ongoing debt service payments follow, increasing the relative demand for apartment units.

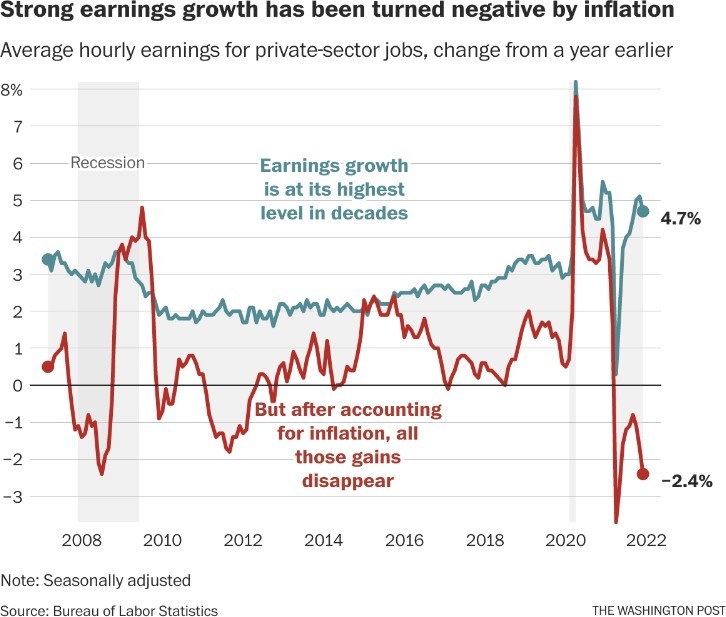

Higher wages result in higher rental affordability: Overall, average hourly earnings for private-sector jobs have increased about five percent in 2022, the highest increase in years. While not outpacing inflation, these higher wages will allow for greater rental payments. Moreover, I anticipate that even higher wages are forthcoming as employers seek to fill open positions.

- Other traditional inflation hedges, notably gold or other commodities, don’t pay dividends: While gold, commodities, and other real assets (e.g., collectibles) can be inflationary hedges, they don’t pay dividends or have income streams, and can have high carrying costs.

Meanwhile, other macro-themes providing tailwinds to multifamily investments (e.g., constrained supply, demographic shifts, elevated levels of student debt) remain firmly intact.

Finally, history also tells us that markets cannot be timed, with peaks and troughs known only in hindsight. Therefore, most investors should simply stay the course.

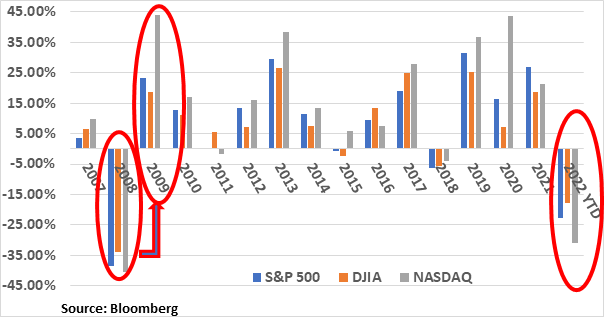

As I mentioned in our last quarterly memo, markets and investor sentiment are fickle things, and it is generally a fool’s errand to chase what’s hot and simply sell what’s cold, and if one picture tells 1,000 words in this regard, it has to be this:

Imagine you were back in 2008, and reliving the Great Recession, when equity prices fell nearly 40%. Was anyone predicting that the market would bounce back the following year? Fast forward to today, with equity indices down more than 20% and the NASDAQ down almost 31% in just the first five-plus months of 2022. Obviously, I cannot predict that equity markets will bounce back during the second half of the year or in 2023, but I sure wouldn’t bet against it.

Finally, thank goodness there remains one place on the planet seemingly impervious to inflationary pressures. So, if news on inflation and higher prices has you down, never forget that a hotdog and bottomless drink remain $1.50 at your nearest Costco. I will see you there.